Avalanche Economic Model: A Systems Engineering Perspective

Executive Summary

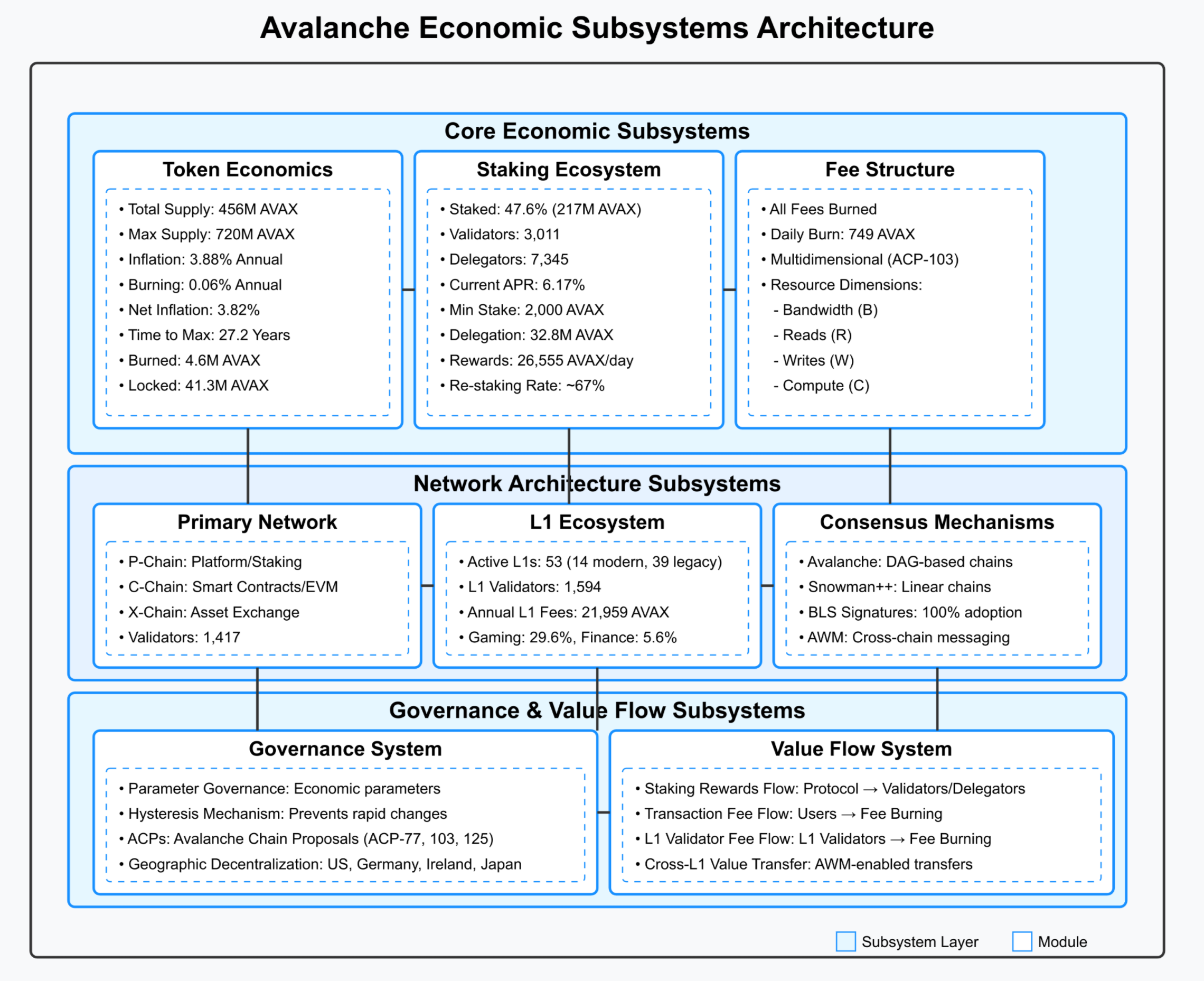

The Avalanche network represents a complex adaptive system where technical and economic components influence each other continuously. Its unique architecture of a Primary Network with application-specific Layer 1 blockchains (L1s) creates distinct economic challenges and opportunities that require a systems-level understanding to navigate effectively. This analysis builds upon the foundational understanding established in Avalanche Economy relative to the Open Economy.

This report analyzes the Avalanche blockchain using model-based systems engineering (MBSE) principles. Section one introduces the MBSE methodology used, and introduces the core economic principles of Avalanche. Section two decomposes Avalanche into five interconnected subsystems: Staking Dynamics, Token Supply, Fee Dynamics, L1 Ecosystem, and Governance. The interaction of these components are analyzed to consider their creation of emergent behaviors. Section three introduces a multigraph state-space model that captures how participants engage with the system in multiple roles simultaneously. This approach reveals economic patterns and incentive structures not visible when viewing each mechanism in isolation.

The remainder of the document explores how these analytical frameworks deliver practical value through model applications for testing economic hypotheses in order to provide The Avalanche network with tangible benefits including reduced unintended consequences, enhanced adaptability, and improved governance decision-making.

1. Introduction: MBSE Applied to Avalanche

1.1 The Need for Model-Based Systems Engineering in Blockchain

Blockchain protocols are not merely technical infrastructures; they are socio-technical systems where humans and automated agents interact within a complex framework of incentives and constraints. As Shevchenko notes, “Model-based systems engineering (MBSE) is a formalized methodology used to support the requirements, design, analysis, verification, and validation associated with the development of complex systems” [1].

Traditional economic analyses often examines blockchain mechanisms in isolation, missing critical interactions that lead to unintended consequences. For instance, when Ethereum transitioned to Proof of Stake, the relationship between validator economics and network security required a systems approach to fully understand the emergent properties [2].

For Avalanche, with its unique Primary Network and L1 architecture, understanding the interplay between subsystems is even more critical. Each component influences others in ways that are difficult to predict without a systems perspective. For example, changes to fee structures (ACP-103) not only affect user behavior but also impact token supply through burn mechanisms, which in turn influences staking dynamics [3]. For detailed technical implementation of these mechanisms, see Mechanism Taxonomy.

1.2 Core Economic Principles of Avalanche

Avalanche’s economic design embodies several key principles that differentiate it from other blockchain networks (detailed in Economic Taxonomy):

Capped Supply with Variable Issuance: Avalanche has a maximum supply cap of 720 million AVAX tokens, with approximately 457.3 million currently in circulation as of April 2025 [4]. Unlike fixed-schedule issuance models like Bitcoin, Avalanche incorporates governance-adjustable parameters that can modify emission rates in response to network conditions.

Deflationary Mechanism Through Fee Burning: Rather than redistributing transaction fees to validators (as in Bitcoin or Ethereum’s pre-London model), all transaction fees in Avalanche are burned. This creates a deflationary pressure that increases with network usage [5][4].

Flexible Staking Framework: Avalanche’s staking mechanism allows varied time commitments (14-365 days) with rewards that scale with duration, creating natural incentives for long-term network security (learn more about staking) [5].

Multi-Network Architecture: Unlike single-chain designs, Avalanche’s Primary Network acts as a security foundation for application-specific L1 blockchains, creating a federation of specialized chains with shared security (L1 documentation) [4].

Dynamic Fee Structure: Introduced in ACP-103 (see ACP Summaries for detailed analysis), Avalanche employs a multidimensional fee mechanism that adjusts based on network congestion across different resource dimensions (bandwidth, reads, writes, compute) [3].

Governance Hysteresis: Parameter changes in Avalanche include built-in stability mechanisms to prevent rapid oscillations, a design principle borrowed from control systems engineering (governance overview) [5].

Continuous Fee Model for L1 Validators: ACP-77 (see ACP Summaries for detailed analysis) introduced a shift from large upfront stakes to a continuous fee model for L1 validators, reducing barriers to entry while maintaining security guarantees [3].

1.3 Key Network Participants

The Avalanche network comprises several types of participants, each with distinct roles and incentives (see Participant Roles Taxonomy for detailed role definitions and relationships):

Validators (≈1,956 nodes as of April 2025) secure the network by staking AVAX tokens and participating in the consensus process. They are further divided into Primary Network validators (1,491) and L1-specific validators (465) [4].

Delegators (≈7,560 unique accounts with 40,809 total delegations) are token holders who stake their AVAX to validators without running nodes themselves, earning a portion of validation rewards [4].

Users conduct transactions, interact with applications, and pay fees that are subsequently burned.

L1 Validators (66 active L1s with 27 using the modern architecture) establish and maintain application-specific blockchains that leverage the security of the Primary Network [4].

Developers build applications and services on both the Primary Network and various L1s.

Token Holders maintain AVAX for investment purposes or to use platform services.

Governance Participants Engage in the protocol’s decision-making processes through voting on parameter changes and protocol upgrades.

Understanding how these participants interact across multiple subsystems is essential for comprehending Avalanche’s economic dynamics as a whole. For a comprehensive analysis of participant interactions and behaviors, see Subsystem_Analysis_and_MultiGraph.

2. System Decomposition: The Five Pillars of Avalanche Economics

Systems engineering teaches us that complex systems are best understood by decomposing them into manageable subsystems while carefully analyzing the interfaces between these components. For Avalanche, we identify five critical subsystems that together form its economic foundation. For detailed mathematical modeling of these subsystems and their interactions, see Subsystem_Analysis_and_MultiGraph.

2.1 Staking Dynamics Subsystem

The Staking Dynamics subsystem forms the backbone of Avalanche’s security model. It encompasses all mechanisms related to token staking, delegation, and reward distribution.

As of April 2025, approximately 239.2 million AVAX (52.3% of the circulating supply) is staked across the network [4]. This comprises Validator Stake of 202.8 million AVAX (44.35% of supply) and Delegation Stake of 36.3 million AVAX (7.94% of supply). The network maintains 1,956 active validators, divided between Primary Network validators (1,491) and L1 validators (465). Additionally, 7,560 unique delegators manage 40,809 delegation positions across the staking ecosystem [4].

Staking in Avalanche is not static but represents a continuous flow of tokens in and out of the staking pool. Key flow variables include the New Stake Rate (the rate at which new tokens enter the staking system), Unstake Rate (the rate at which tokens exit the staking system), Reward Distribution (generates staking rewards based on participation and duration), and Restaking Behavior (validators typically restake a higher percentage of rewards compared to delegators).

The staking system operates within constraints defined by several key parameters: Minimum Validator Stake of 2,000 AVAX, Maximum Validator Stake of 3,000,000 AVAX, Minimum Delegator Stake of 25 AVAX, Staking Duration of 14-365 days (with rewards scaling based on duration), Delegation Fee Range starting at 2% and set by validators, Maximum Delegation Weight of 5× the validator’s own stake, and Current Staking APR of 6.13% (weighted average) [4].

The staking subsystem exemplifies the need for systems thinking in blockchain design. The staking reward function incorporates both global network parameters and individual staking choices, creating a complex adaptive system where changes in one component ripple throughout the network. The reward function, as specified in the Avalanche documentation [5], incorporates factors including total supply cap, current supply, individual stake amount, staking duration, and network-wide staking participation. This creates a system where individual decisions aggregate to influence network-wide economic conditions, which in turn affect future individual decisions—a classic feedback loop that requires systems modeling to fully understand. The mathematical formalization of these feedback dynamics is detailed in Differential_Specification. The current 52.3% staking ratio represents an equilibrium point where the incentives for staking versus using tokens for transactions or other purposes have balanced out across the network [4].

2.2 Token Supply Subsystem

The Token Supply subsystem governs the creation, destruction, and circulation of AVAX tokens throughout the ecosystem.

As of April 2025 [4], the Avalanche network has a Total Supply of 457.3 million AVAX, with a Maximum Supply Cap of 720 million AVAX, Staked Supply of 239.2 million AVAX (52.3% of total), and Burned Tokens that are continuously increasing through transaction fees.

The supply constantly evolves through several flow processes, including the Issuance Rate (new tokens created through staking rewards), Burning Rate (tokens permanently removed through transaction fees), Net Inflation (the difference between issuance and burning), and Unlock Rate (tokens becoming available from vesting schedules).

Key parameters governing the supply include Time to Maximum Supply (dependent on issuance rates, which are governance-adjustable) and Annual Scheduled Unlocks (distribution schedule for any locked tokens).

The token supply subsystem exhibits classic feedback behaviors. For instance, as network usage increases, more fees are burned, reducing the circulating supply and potentially increasing token value. This value increase may attract more users, creating a positive feedback loop. However, there are counterbalancing forces: as token value increases, the dollar cost of using the network also rises, potentially dampening adoption. This balance between opposing feedbacks is a hallmark of complex systems that cannot be understood through linear analysis alone. The supply subsystem also demonstrates control theory principles, as the system must balance between inflation (to reward security providers) and deflation (to capture value from usage). The mathematical treatment of these control dynamics is provided in Differential_Specification. The current 52.3% staking ratio indicates a significant portion of the supply is being used for network security rather than active circulation, creating a natural scarcity effect beyond the capped supply mechanism [4].

2.3 Fee Dynamics Subsystem

The Fee Dynamics subsystem governs how users pay for network resources and how these payments affect the broader economy.

Avalanche’s fee model, enhanced through ACP-103 and ACP-125 (detailed in ACP Summaries), represents one of the most sophisticated in blockchain [3]. Rather than a one-dimensional gas price, Avalanche fees account for multiple types of resource consumption: Bandwidth (the size of transactions in bytes), Storage Reads (operations that read from the state database), Storage Writes (operations that modify the state database), and Compute (CPU time required for transaction processing). This multidimensional approach creates a more accurate pricing mechanism for network resources, a principle borrowed from systems engineering where complex resources require nuanced allocation mechanisms.

The fee mechanism employs an exponential controller that adjusts prices based on network congestion: When network usage exceeds the target capacity, fees increase exponentially, quickly pricing out lower-value transactions. When usage falls below capacity, fees decrease gradually, making the network more accessible. This approach, inspired by control systems engineering, maintains network stability while maximizing utility. The fee adjustment algorithm introduced in ACP-103 represents a classic feedback control system [3].

All fees in Avalanche are burned rather than redistributed, creating a direct link between network usage and token scarcity. The L1 ecosystem contributes approximately 7,508 AVAX annually in fees [4], adding to the deflationary pressure generated by activity on the Primary Network.

The fee subsystem illustrates how control theory can be applied to blockchain economics. The exponential controller implemented in ACP-103 provides rapid response to congestion while preventing fee volatility during normal operation [3]. This approach recognizes that blockchain networks, like other complex systems, require feedback mechanisms that respond proportionally to disturbances. A fixed fee would either be too high during low demand (reducing accessibility) or too low during high demand (causing congestion).

2.4 L1 Ecosystem Subsystem

Avalanche’s unique multi-chain architecture creates a distinct economic subsystem around Layer 1 blockchains that leverage the Primary Network’s security.

As of April 2025, the network supports 66 active L1 chains (with 69 total active blockchains), with 27 using the modern continuous fee model introduced in ACP-77 and 39 using the legacy subnet model [4]. These L1s collectively maintain 692 L1 validators and contribute significantly to the overall economic activity of the network. The L1 ecosystem shows strong diversification by sector, with gaming (35.8%), healthcare (6.0%), metaverse (6.0%), finance (4.5%), AI (4.5%), and IP (4.5%) representing the largest categories [4]. This specialization demonstrates how the L1 architecture enables domain-specific optimization.

A key innovation introduced in ACP-77 is the continuous fee model for L1 validators [3]. Instead of large upfront stakes, validators pay a continuous fee based on network congestion. The model includes a Base Fee Rate of 512 nAVAX/second (~1.33 AVAX/month) when the network is below target capacity, a Scaling Mechanism where fees increase exponentially as the number of validators approaches and exceeds the target capacity (10,000 validators), and a Capacity Ceiling with a maximum capacity set at 20,000 validators. This approach applies principles from queuing theory and congestion pricing, concepts frequently used in systems engineering for resource allocation in complex networks. The total projected annual fees from L1s amount to approximately 7,508 AVAX [4].

The L1 ecosystem demonstrates how modular design principles from systems engineering can be applied to blockchain architecture. By separating application-specific chains from the security layer, Avalanche achieves both specialization and scale. This separation of concerns—a fundamental principle in systems design—allows each L1 to optimize for its specific use case while leveraging shared security infrastructure. The continuous fee model creates an elegant economic mechanism that balances accessibility with sustainable growth. Moreover, the interaction between the Primary Network and L1 chains illustrates the importance of well-defined interfaces in systems engineering. The security guarantees, messaging protocols, and economic relationships between these components are carefully designed to maintain system integrity while enabling innovation. The diversity of L1 applications (with gaming representing 35.8% of all chains) demonstrates market-driven specialization emerging from the modular architecture [4]. Each domain can optimize its blockchain parameters without compromising the security or performance of other applications.

2.5 Governance Subsystem

The Governance subsystem enables the Avalanche network to adapt and evolve while maintaining stability.

Avalanche employs a parameter-based governance model where specific network variables can be adjusted through governance processes. These include staking reward rates, fee calculation parameters, L1 validator capacity targets, and other economic and technical parameters. The governance process has attracted participation from over 1,400 primary network validator participants [4], demonstrating significant community engagement in protocol evolution.

A unique feature of Avalanche’s governance is the concept of “hysteresis” or change resistance [5]. This mechanism prevents parameters from changing too quickly or too dramatically, providing stability while still allowing adaptation. For a parameter change to be valid, it must satisfy maximum change rate constraints based on time since last change and minimum time interval between changes. This approach borrows directly from control systems engineering, where hysteresis is used to prevent oscillation in feedback systems.

The governance subsystem exemplifies how systems thinking can be applied to organizational structures in blockchain networks. Rather than viewing governance as separate from the technical protocol, Avalanche integrates governance capabilities directly into the system design. This integration creates a self-modifying system capable of adaptation without destabilization—a key characteristic of resilient complex systems. The hysteresis mechanisms prevent the governance equivalent of “thrashing” in computer systems, where rapid changes lead to inefficiency and instability. From a systems engineering perspective, the governance subsystem provides the adaptation mechanisms necessary for long-term sustainability in a changing environment. The participation of 1,401 ACP contributors [4] creates a diverse input structure that helps avoid optimization for any single stakeholder group.

2.6 Subsystem Interactions and Emergent Properties

The true power of systems engineering emerges not in the analysis of individual components but in understanding their interactions. In Avalanche, several critical interaction points create network-wide behaviors. The Staking-Supply Feedback Loop where staking rewards increase the token supply, while the percentage of tokens staked affects reward rates creates a dynamic equilibrium between inflation and security. The current 52.3% staking ratio [4] represents a stabilization point in this feedback system. The Fee-Supply Balance where fee burning reduces supply, creating deflationary pressure that increases with network usage, counterbalances the inflationary pressure from staking rewards. The L1 ecosystem contribution of 7,508 AVAX annually in fees [4] adds a significant component to this balance. L1-Validator Economics where L1 validators contribute to network security while also supporting specific applications creates a dual incentive structure that influences validator behavior. The 66 active L1s with 692 validators [4] demonstrate this economic relationship in practice. Governance-Parameter Coupling means changes to one parameter often necessitate adjustments to others, requiring holistic governance decisions that consider system-wide impacts. The 1,401 primary network validators [4] face the challenge of navigating these complex interdependencies.

These interactions create emergent properties not visible when examining each subsystem in isolation. Economic Equilibria emerge as the system naturally tends toward specific equilibrium states where staking participation, fee levels, and L1 adoption balance each other. The current 52.3% staking ratio [4] represents one such equilibrium. Self-Regulation occurs as price mechanisms and incentive structures enable the network to self-regulate in response to changing conditions. The 66 active L1s across diverse sectors [4] demonstrate market-driven specialization without central coordination. Parameter Sensitivity is evident as certain parameters have outsized influence on system behavior, creating leverage points for governance. The 100% BLS adoption rate [4] illustrates successful parameter implementation across the network.

A systems perspective also reveals potential vulnerabilities and resilience patterns. Parameter Coupling means changes to one parameter can have cascading effects, requiring careful monitoring of interdependencies. Stress Testing involves simulating extreme scenarios to ensure system stability under varying conditions. Feedback Loop Management requires identifying and managing positive feedback loops to prevent destabilizing runaway effects.

3. Beyond Mechanism Design: The Multigraph Agent Model

While subsystem analysis (detailed in

Subsystem_Analysis_and_MultiGraph) provides valuable insights into

Avalanche’s economic structure, it still treats participants as idealized

actors within separate mechanisms

[1][8].

In reality, participants engage with multiple aspects of the system

simultaneously, creating complex behavioral patterns that require a more

sophisticated modeling approach to fully understand and predict.

The diagram illustrates the Multigraph Agent Model (MAM) for Avalanche’s economic system, demonstrating how a single agent can simultaneously participate in multiple network roles. The central node (Agent i) maintains AVAX token holdings while engaging across six distinct roles: Primary Network Validator, App User, Governance Participant, Delegator, Market Participant, and L1 Validator. Each connection represents role-specific policies and interactions, such as validator commission rates, application fees, voting power, delegation policies, and trading strategies. The model captures cross-role strategic integration, showing how decisions in one domain influence behaviors in others. This multi-dimensional representation reveals emergent economic patterns and incentive structures not visible in traditional single-role economic models, enabling more accurate analysis of participant behavior in Avalanche’s complex ecosystem.

3.1 The Limitations of Traditional Economic Models

Traditional blockchain economic models operate under several restrictive assumptions that limit their applicability to complex systems like Avalanche [2][5]. These models typically assume participants act within a single role (validator OR delegator OR user), with decisions in one role having no influence on decisions in another role. They further presume participants possess perfect information about the system and exhibit strictly rational behavior in their decision-making processes. Such simplifications, while useful for initial analysis, create significant blind spots when analyzing real-world blockchain economies [8].

The reality of blockchain participation is far more nuanced and interconnected. A single entity in the Avalanche ecosystem frequently occupies multiple roles simultaneously—validating on the Primary Network, operating an L1 chain, participating in governance proposals, and strategically trading tokens based on market conditions [4][7]. Data from April 2025 shows significant overlap between the 1,491 Primary Network validators, the 465 L1 validators, and the 1,401 governance participants [4]. These overlapping responsibilities create decision frameworks where actions in one domain necessarily influence strategies in others. For example, a validator who also operates an L1 chain might make different staking decisions than one who focuses solely on validation [3]. This intricate web of cross-domain decision-making creates complex strategic behaviors that traditional single-role economic models fundamentally fail to capture or predict.

3.2 Introducing the Multigraph State-Space Model

To address these limitations and more accurately represent the economic dynamics of the Avalanche network, we propose a Multigraph State-Space Model (MSSM) (see Subsystem_Analysis_and_MultiGraph for detailed implementation). This innovative modeling approach explicitly represents the multifaceted nature of blockchain participation by treating each participant as a potential multi-role agent. The MSSM framework incorporates several fundamental improvements over traditional models, beginning with its recognition of agents as multi-role participants who can simultaneously occupy and balance multiple positions within the ecosystem [8].

The MSSM approach acknowledges that agents maintain role-specific states and strategies—distinct state variables and decision functions for each role they occupy. This granular representation allows the model to capture how participants might optimize differently across their various responsibilities. The model also accounts for cross-role strategic integration, recognizing that decisions made in one role inevitably influence decisions in others, creating complex feedback loops and strategic dependencies [8]. Perhaps most importantly, the MSSM explicitly models interaction networks—the multidimensional relationships between agents across different roles—providing a structural foundation for understanding emergent economic behaviors.

This sophisticated framework enables us to model nuanced behaviors that would be invisible in traditional economic analyses. For instance, it can capture how validators might optimize their delegation fees in response to broader market conditions rather than just staking dynamics [4], how L1 Validators adjust their validation strategies based on pending governance proposals that might affect their operations [3], or how savvy token holders time their market activities to coincide with predictable staking reward distributions [6]. These behavioral patterns, while common in practice, remain invisible to single-role economic models.

3.3 Model Structure and Components

The MSSM represents each agent in the Avalanche ecosystem as a multidimensional node with several key attributes. Each agent maintains specific token holdings (their balance state), a set of role assignments (which may include validator, delegator, L1 validator, governance participant, trader, etc.), strategy functions that determine their decision-making processes for each assigned role, and a comprehensive history of interactions that influences future decisions [6][9]. This rich representation allows the model to capture the full complexity of agent behavior across multiple domains.

Each role within the system carries specific attributes and behavioral patterns that influence agent decision-making. The Validator Role incorporates factors such as staking amount, commission rate, and performance metrics that shape validation strategy [5][9]. The Delegator Role includes delegation amounts, validator selection criteria, and reward history that influence delegation decisions—particularly relevant given the 7,560 unique delegators managing 40,809 delegation positions [4]. The Governance Participant Role encompasses voting history and proposal participation patterns that reveal governance preferences [3]. The Trader Role captures trading strategies and market influence that affect token price dynamics. The L1 Validator Role includes chain parameters and validator recruitment strategies that shape L1 ecosystem development [3][7]. By modeling these roles with appropriate depth, the MSSM achieves a level of behavioral realism impossible in simpler economic models.

The true innovation of the MSSM lies in its multigraph structure, which captures multiple types of relationships between agents and roles. Agent-Role Edges connect agents to their assigned roles, defining the functional capacities each agent possesses within the system. Agent-Agent Edges represent direct relationships between agents, such as delegation connections or transaction patterns, revealing the social and economic networks that influence decision-making. Role-Mediated Edges represent more subtle relationships between agents through shared roles, capturing how agents might influence each other indirectly through role-specific behaviors and expectations. This multilayered network structure creates a rich representation of the complex social and economic interactions that form within the Avalanche ecosystem, enabling analysis of emergent behaviors that arise from these interconnections [8].

3.4 Agent Behavior and Emergent Phenomena

The MSSM’s power becomes evident when we examine how it captures the integration of strategies across roles. The model reveals how Validator-Traders might strategically time token sales to coincide with reward distributions, maximizing returns by leveraging privileged information about reward timing [6]. It shows how Delegator-Governance Participants may systematically vote in alignment with their chosen validators, creating voting blocs that amplify the influence of popular validators [4]. It illustrates how L1 Validators balance resources between Primary Network validation and L1-specific responsibilities, navigating the complex tradeoffs between security contributions and application development [3][7].

These integrated multi-role strategies give rise to emergent phenomena that remain invisible in traditional economic models but have profound implications for network economics and governance [8]. Stake Concentration Cycles emerge as successful validators attract more delegation, gain increased governance influence, and potentially steer protocol decisions to further benefit large validators—creating a self-reinforcing cycle of concentration that traditional models would miss entirely. The current distribution of validator power, with 44.35% of supply controlled by validators versus 7.94% by delegators [4], provides empirical evidence for the importance of these dynamics. Cross-Role Arbitrage opportunities arise when agents can exploit information asymmetries between roles, such as L1 Validators leveraging advance knowledge of chain upgrades to make profitable trading decisions before the broader market [7]. Coalition Formation becomes a natural consequence of the system as agents with complementary roles form implicit or explicit alliances, coordinating actions across staking, governance, and L1 operations to achieve mutually beneficial outcomes that would be impossible for single-role participants [8].

By capturing these sophisticated behavioral patterns and emergent phenomena, the MSSM provides unprecedented insight into the true economic dynamics of the Avalanche network.It reveals how the interplay between different roles creates feedback loops, strategic dependencies, and emergent behaviors that shape network evolution in ways traditional economic models cannot predict or explain [8]. This deeper understanding of multi-role participant behavior enables more effective mechanism design, governance optimization, and economic planning—ultimately supporting the long-term sustainability and success of the Avalanche ecosystem [5][6].

4. Model Applications

The systems engineering approach—combining subsystem decomposition with multigraph agent modeling—provides powerful tools for optimizing Avalanche’s economic design. Our five-pillar decomposition enables analysis of specific mechanisms while tracking cross-system effects. This approach identifies economic thresholds where system behavior changes qualitatively and reveals emergent properties that traditional analyses miss. The current 52.3% staking ratio and 66 active L1s [4] provide empirical calibration points for these models.

While subsystem analysis focuses on mechanisms, the Multigraph State-Space Model (MSSM) captures participants who engage with multiple system aspects simultaneously. This model identifies incentive misalignments across different roles, discovers opportunities for strategic behaviors that exploit subsystem disconnects, and enables holistic parameter optimization. This approach prevents optimizing one component at the expense of overall system health.

These modeling techniques provide a foundation for testing economic hypotheses about the Avalanche network (see economic_hypotheses for specific testable hypotheses). Key research domains include fee burning dynamics (exploring self-reinforcing cycles between network activity and token scarcity), staking-utility balance (identifying optimal staking ratios), L1 ecosystem sustainability (evaluating the continuous fee model’s impact), and dynamic fee optimization (analyzing multidimensional resource pricing).

Our testing approach lays a foundation for the application of methodologies like system dynamics modeling, agent-based simulation, empirical validation, sensitivity analysis, and scenario planning. The mathematical framework for these approaches is formalized in Differential_Specification. This multi-method framework enables rigorous evaluation while accounting for the complex adaptive nature of blockchain systems. By applying systems engineering principles to these economic questions, the Avalanche ecosystem can develop more robust mechanisms, optimize parameters based on empirical evidence, and anticipate how changes propagate network-wide—ultimately supporting Avalanche’s long-term economic sustainability and competitive differentiation.

5. Systems Thinking as a Competitive Advantage

Avalanche’s economic model represents a significant advancement in blockchain design, incorporating sophisticated mechanisms across multiple interconnected subsystems. By applying MBSE principles to understand and evolve this system, the Avalanche community gains several advantages:

Reduced Unintended Consequences: Systems thinking helps identify potential issues before they manifest in production.

Enhanced Adaptability: A modular design with well-understood interfaces makes it easier to evolve individual components without destabilizing the whole system.

Improved Governance: Decision-makers equipped with systems models can make more informed choices about parameter adjustments and protocol upgrades.

Stakeholder Alignment: A shared systems model helps align diverse stakeholders around common understanding of how the network functions.

The complex nature of blockchain economies demands sophisticated modeling approaches. By embracing MBSE and multigraph agent modeling, Avalanche positions itself at the forefront of economic design in the blockchain space—creating a foundation for sustainable growth and adaptation in an ever-changing technological and regulatory landscape.

6. Next Steps

The Differential Specification will provide the mathematical foundations necessary for rigorous modeling of Avalanche’s economic system. This specification will include formal definitions of state variables for each subsystem, the algebraic and differential equations governing their evolution, and the interaction terms capturing cross-subsystem effects. It will define parameter spaces with constraints, boundary conditions, and stability requirements that any implementation must satisfy. This specification will enable quantitative modeling of system dynamics while ensuring that different implementations maintain mathematical consistency, establishing a common language for economic analysis across the Avalanche ecosystem.

The Economic Hypothesis Testing Framework will detail methodological specifications for evaluating economic hypotheses about the network. This framework will define statistical criteria for hypothesis validation, data requirements for testing, and the logical structure of experimental designs appropriate for different hypothesis types. It will specify appropriate counterfactual constructions, confounding variables to control for, and sensitivity analysis procedures to ensure robust conclusions. Rather than implementing specific tests, this framework will provide the blueprint for how testing should be conducted to maintain scientific validity and practical relevance in the Avalanche context.

The System Protocol Map will deliver a comprehensive specification of information flows, decision points, and economic exchanges throughout the Avalanche network. This map will formally define the interfaces between subsystems, the protocols governing interactions between agents, and the decision logic employed by different participant types. It will specify how information propagates through the system, where economic value is created and captured, and how governance decisions influence system parameters. This specification will serve as an authoritative reference for understanding the complete economic architecture of Avalanche, enabling stakeholders to identify leverage points for optimization and potential areas for economic innovation.

References

[1] Shevchenko, N. (2020). Introduction to Model Based Systems

Engineering. Software Engineering Institute, Carnegie Mellon University. Retrieved from https://insights.sei.cmu.edu/blog/introduction-model-based-systems-engineering-mbse {#[1]-shevchenko,-n.-(2020).-introduction-to-model-based-systems-engineering.-software-engineering-institute,-carnegie-mellon-university.-retrieved-from-https://insights.sei.cmu.edu/blog/introduction-model-based-systems-engineering-mbse}

[2] Buterin, V. et al. (2022). Ethereum 2.0 Specification. Ethereum

Foundation. Retrieved from https://ethereum.org/en/eth2/ {#[2]-buterin,-v.-et-al.-(2022).-ethereum-2.0-specification.-ethereum-foundation.-retrieved-from-https://ethereum.org/en/eth2/}

[3] Avalanche Foundation. (2023). Avalanche Community Proposals (ACPs).

GitHub. Retrieved from https://github.com/avalanche-foundation/ACPs {#[3]-avalanche-foundation.-(2023).-avalanche-community-proposals-(acps).-github.-retrieved-from-https://github.com/avalanche-foundation/acps}

[4] Snowpeer. (2025, April 21). Avalanche Network Statistics. Retrieved

from https://snowpeer.io/ {#[4]-snowpeer.-(2025,-april-21).-avalanche-network-statistics.-retrieved-from-https://snowpeer.io/}

[5] Ava Labs. (2020). Avalanche Consensus Protocol Whitepaper. Retrieved

from https://www.avalabs.org/whitepapers {#[5]-ava-labs.-(2020).-avalanche-consensus-protocol-whitepaper.-retrieved-from-https://www.avalabs.org/whitepapers}

[6] Ava Labs. (2020). Avalanche Platform Whitepaper. Retrieved from

https://www.avalabs.org/whitepapers {#[6]-ava-labs.-(2020).-avalanche-platform-whitepaper.-retrieved-from-https://www.avalabs.org/whitepapers}

[7] Ava Labs. (2019). The Avalanche Platform: Enabling Internet‑Scale

Decentralized Applications. Retrieved from https://www.avalabs.org/whitepapers {#[7]-ava-labs.-(2019).-the-avalanche-platform:-enabling-internet‑scale-decentralized-applications.-retrieved-from-https://www.avalabs.org/whitepapers}

[8] Zargham, M., & Ben-Meir, I. (2023, August 3). Block by Block:

Managing Complexity with Model-Based Systems Engineering. BlockScience Blog. https://blog.block.science/block-by-block-managing-complexity-with-model-based-systems-engineering/ {#[8]-zargham,-m.,-&-ben-meir,-i.-(2023,-august-3).-block-by-block:-managing-complexity-with-model-based-systems-engineering.-blockscience-blog.-https://blog.block.science/block-by-block-managing-complexity-with-model-based-systems-engineering/}

[9] Ava Labs. (2020). Avalanche Network Documentation. Retrieved from

https://docs.avax.network/ {#[9]-ava-labs.-(2020).-avalanche-network-documentation.-retrieved-from-https://docs.avax.network/}