Avalanche Differential Specification and Protocol Architecture

1. Differential Specification Overview

This differential specification characterizes how the Avalanche economic system evolves over time, providing a mathematical framework for understanding system dynamics that may be governable, environmental, relational, or mechanistic. The specification builds upon the Avalanche Economic Network exploratory analysis developed in previous milestones. This document seeks to formalize the state dynamics and feedback loops inherent in in the avalanche network.

The Avalanche network represents a complex adaptive dynamical system where technical and economic components influence each other continuously. This creates distinct economic challenges and opportunities that require sophisticated control-theoretic understanding to navigate effectively. This specification provides formal and analytic contexts through which to analyze the unique architecture of the Avax Token, the Primary Network and application-specific Layer 1 blockchains (L1s) that the Avalanche network provides.

Building on the foundational economic concepts (Milestone 1) and systems engineering perspective (Milestone 2), this differential specification provides a rigorous mathematical framework consisting of coupled differential equations that model the dynamic interactions between token supply, staking behavior, fee markets, and the L1 ecosystem. The specification transforms qualitative understanding into mathematical relationships, enabling systematic analysis of how financial and governance interfaces can impact the network behavior.

2. Mathematical Framework and Control Theory Foundations

Mathematical Notation Reference

The following table provides a quick reference for all mathematical notation used throughout the differential specification, making it easier for readers to understand the mathematical framework without having to search through the document for definitions.

2.1 State Variables

| Symbol | Description | Units/Type |

|---|---|---|

| Staking Subsystem | ||

| S₁ | Total staked amount | AVAX |

| S₂ | Validator-staked amount | AVAX |

| S₃ | Delegator-staked amount | AVAX |

| S₅ | Staking APR | Percentage |

| S₆ | Active validators count | Integer |

| Token Supply Subsystem | ||

| T₁ | Total supply | AVAX |

| T₂ | Circulating supply | AVAX |

| T₄ | Cumulative burned | AVAX |

| T₅ | Token issuance rate | AVAX/time |

| Fee Dynamics Subsystem | ||

| F₁ | Gas price | nAVAX |

| F₂ | Network utilization | Ratio |

| F₃ | Fee burn rate | AVAX/time |

| F₄ | Network utilization percentage | Percentage |

| L1 Ecosystem Subsystem | ||

| L₁ | Active L1 count | Integer |

| L₄ | L1 fee burn rate | AVAX/time |

| Governance Subsystem | ||

| G₁ | Standard Track ACP Count | Integer |

| G₂ | Best Practices Track ACP Count | Integer |

| G₃ | Meta Track ACP Count | Integer |

| G₄ | L1 Track ACP Count | Integer |

| G₅ | Proposed ACP Count | Integer |

| G₆ | Implementable ACP Count | Integer |

| G7 | Stale ACP Count | Integer |

| G8 | Activated ACP Count | Integer |

2.2 Control Parameters

| Symbol | Description |

|---|---|

| θ | Inflation rate parameters |

| θ_ref | Reference inflation rate |

| θₑ | Effective inflation parameter |

| K | Fee adjustment constant |

| Ω | Target network utilization |

| Ω_target | Target utilization value |

| τ | Staking duration parameters |

| γ | Adaptation gain (scalar) |

| Γ | Adaptation gain matrix |

| M | Fee multiplication factor |

2.4 Functions

| Symbol | Description | Type |

|---|---|---|

| φₛ | Staking inflow function | Dynamic |

| ψᵤ | Unstaking outflow function | Dynamic |

| ηᵣ | Reward distribution function | Dynamic |

| Ψᵢ | Token issuance function | Dynamic |

2.6 Dimensions

| Symbol | Description |

|---|---|

| n | State space dimension |

| m | Control input dimension |

| p | Disturbance dimension |

| q | Output dimension |

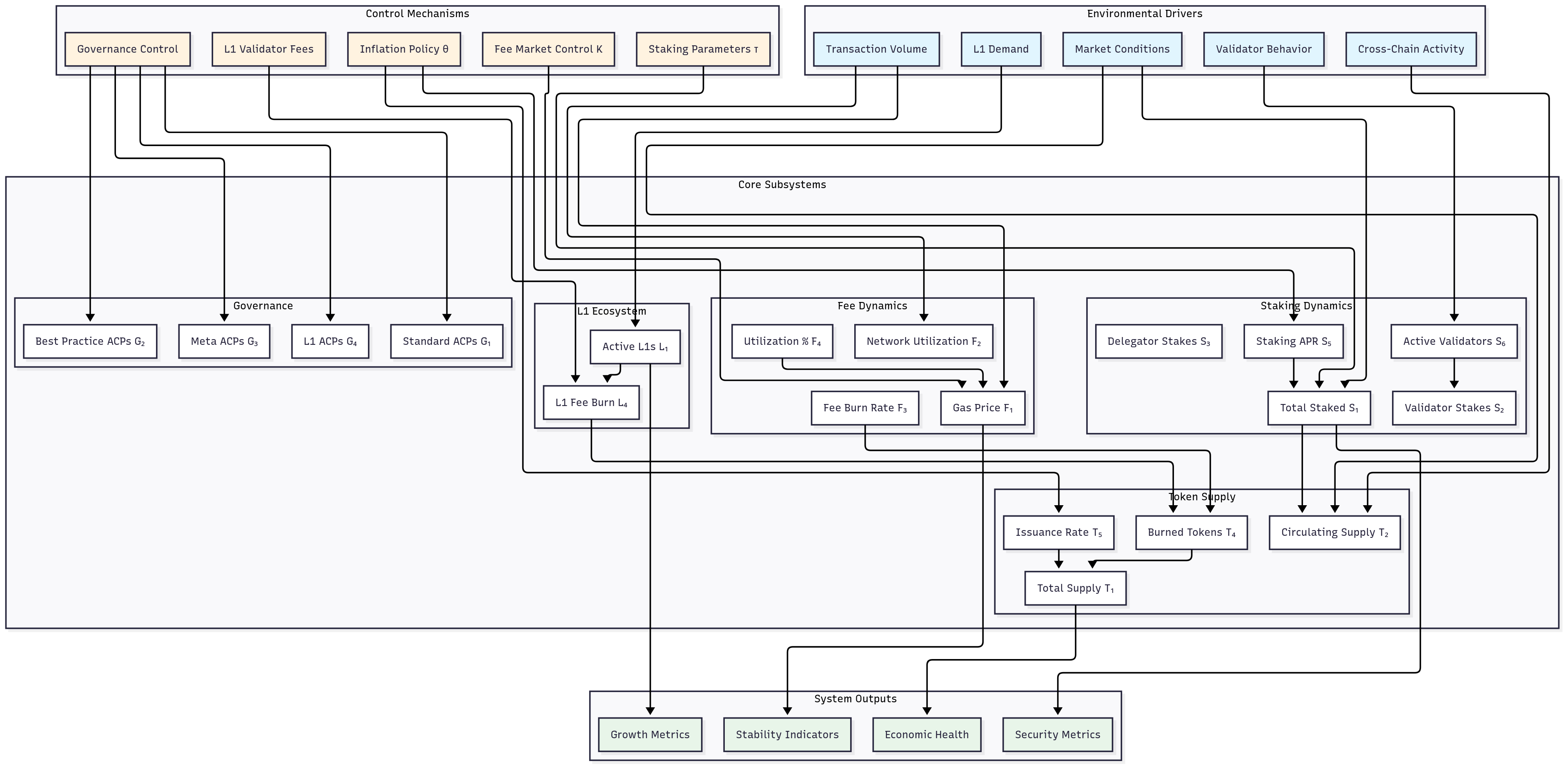

2.7 System Architecture Visualization

The following diagram illustrates the interconnected subsystems and their relationships within the Avalanche economic model:

3. Component Specification

3.1 Environmental Processes

Environmental processes represent activity that can be modeled with potentially state-dependent stochastic processes. These driving processes are stochastic generators during design phase and fed with real data during live system operation.

Environmental Process Driver 1: Transaction Volume This external process models transaction volume demand and outputs to multiple mechanisms. The fee market mechanism directly depends on this driver, while staking rewards and L1 validator economics are indirectly affected through network utilization patterns.

Environmental Process Driver 2: Market Conditions External market forces including AVAX price movements, cryptocurrency market sentiment, and macroeconomic conditions. These conditions affect staking behavior, validator participation, and L1 creation rates.

Environmental Process Driver 3: L1 Demand External demand for application-specific blockchains drives L1 creation and validator requirements. This process models the rate at which new projects seek to deploy L1 and existing L1s may be abandoned.

Environmental Process Driver 4: Validator Behavior Models the decision-making processes of validators including entry/exit decisions, delegation acceptance, and operational reliability. This driver incorporates behavioral economics principles affecting validator strategies.

Environmental Process Driver 5: Cross-Chain Activity Represents activity on bridges and cross-chain protocols that may affect AVAX demand and supply dynamics. This includes wrapped token creation, cross-chain DeFi interactions, and interoperability usage.

3.2 Behavioral Processes

Behavioral processes represent activity that can be modeled with state-dependent functions, which are deterministic responses to system state by uncontrolled actors.

User Behavior Function 1: Staking Decision Agents choosing to stake AVAX tokens based on expected returns, risk assessment, and opportunity costs. The decision incorporates factors including current APR, staking duration options, and alternative yield opportunities.

User Behavior Function 2: Validator Role Agents choosing to operate validators based on expected rewards, operational costs, and technical capabilities. The decision affects both primary network and L1 validator participation.

User Behavior Function 3: Delegator Role Agents choosing to delegate stake to validators based on validator performance, commission rates, and delegation capacity. This behavior affects validator economics and network decentralization.

User Behavior Function 4: L1 Developer Role Agents choosing to develop applications on L1 blockchains based on economic viability, technical requirements, and market opportunities. This behavior drives L1 ecosystem growth.

User Behavior Function 5: Transaction Submission Users submitting transactions based on fee levels, network congestion, and transaction urgency. This behavior drives fee market dynamics and network utilization.

User Behavior Function 6: Governance Participation Agents participating in governance decisions based on stake holdings, proposal impacts, and expected outcomes. This behavior affects protocol evolution and parameter adjustments.

3.3 Controlled Processes: Algorithmic Policy

Controlled decision processes are elements of the decision-making layer that remain under control of system designers. These processes are more structural and encode fundamental protocol constraints.

Control Function 1: Inflation Rate Policy Algorithmic control of token inflation based on staking participation, network utilization, and economic targets. The policy follows the official Avalanche reward formula with consumption rate adjustments.

Control Function 2: Fee Market Control Dynamic adjustment of transaction fees based on network congestion following the ACP-103 multidimensional fee mechanism. The controller maintains target utilization across different resource dimensions.

Control Function 3: L1 Validator Fee Policy Control of continuous fees for L1 validators following ACP-77 specification. The policy balances accessibility with network sustainability through exponential fee scaling.

Control Function 4: Staking Parameter Control Management of staking parameters including minimum stake amounts, duration limits, and reward distribution mechanisms. These parameters affect security and participation incentives.

Control Function 5: Governance Parameter Control Control of governance mechanisms including voting thresholds, proposal requirements, and parameter change processes. These controls affect system adaptability and democratic participation.

3.4 System State Updates: Mechanisms

Mechanisms represent the deterministic consequences of potentially non-deterministic inputs. These logical blocks are direct consequences of the protocol specification applied over the state space.

Mechanism 1: Staking Rewards Distribution Calculation and distribution of staking rewards based on participation, duration, and network conditions. The mechanism implements the official Avalanche reward formula with duration-dependent multipliers.

Mechanism 2: Fee Processing and Burning Collection of transaction fees and their subsequent burning, creating deflationary pressure. The mechanism handles multidimensional fee calculation and conservation law enforcement.

Mechanism 3: Token Issuance Minting of new AVAX tokens according to the inflation schedule and staking participation levels. The mechanism ensures proper token creation and distribution to reward recipients.

Mechanism 4: L1 Validator Management Registration, validation, and fee collection for L1 validators. The mechanism manages the transition between legacy and modern L1 implementations following ACP-77.

Mechanism 5: Validator Set Management Selection and management of Primary Network validators based on stake amounts, performance, and network requirements. The mechanism ensures adequate validator diversity and security.

Mechanism 6: Delegation Processing Management of delegation relationships between delegators and validators, including reward distribution and delegation capacity constraints.

Mechanism 7: Governance Execution Processing of governance proposals and parameter updates based on voting outcomes and protocol requirements.

4. State Variables

4.1 System-Level State Variables

State Variable 1: Total Supply (T₁) Current total supply of AVAX tokens including all minted tokens. Updated by token issuance mechanism and constrained by maximum supply cap of 720 million AVAX.

State Variable 2: Total Staked (S₁) Total amount of AVAX tokens currently staked across all validators and delegators. Currently approximately 273.3 million AVAX representing 52.3% of circulating supply.

State Variable 3: Circulating Supply (T₂) Amount of AVAX tokens available for circulation, calculated as total supply minus staked tokens and locked tokens. Currently approximately 454.6 million AVAX.

State Variable 4: Cumulative Burned (T₄) Total amount of AVAX tokens permanently removed through fee burning mechanisms. Currently approximately 14.6 million AVAX with ongoing daily burning.

State Variable 5: Active Validators (S₆) Number of active validators securing the Primary Network. Currently approximately 1,372 validators with minimum stake requirements of 2,000 AVAX.

State Variable 6: Active L1s (L₁) Number of active Layer 1 blockchains operating on the network. Currently 66 active L1s with 45 using modern ACP-77 compliant architecture.

State Variable 7: Network Utilization (F₄) Current network utilization as percentage of capacity. Maintained around 30% through dynamic fee adjustments.

State Variable 8: Staking APR (S₅) Current annual percentage return for staking participation. Currently approximately 9.46% based on network conditions and staking duration.

4.2 Agent-Level State Variables

State Variable 9: Validator Stakes Individual stake amounts for each validator including self-stake and delegated amounts. Structured as agent-role relationships in the multi-graph model.

State Variable 10: Delegator Stakes Individual delegation amounts for each delegator including validator selection and delegation timing. Tracked through agent-role edges.

State Variable 11: L1 Validator Commitments Commitments of validators to specific L1 blockchains including fee payment status and validation performance.

State Variable 12: Token Holdings Individual AVAX token holdings for each agent including liquid balances and locked amounts.

State Variable 13: Governance Participation Participation records for each agent in governance processes including voting history and proposal activity.

5. Performance Indicators and Metrics

5.1 Security Metrics

Performance Indicator 1: Network Security Ratio Ratio of staked tokens to total supply, indicating network security level. Target range of 50-60% based on economic security requirements and liquidity needs.

Performance Indicator 2: Validator Decentralization Herfindahl-Hirschman Index (HHI) of validator stake distribution, measuring concentration. Lower values indicate better decentralization.

Performance Indicator 3: Delegation Efficiency Ratio of delegated stake to total stake, indicating capital efficiency. Current level around 75% demonstrates effective delegation mechanisms.

5.2 Economic Health Metrics

Performance Indicator 4: Token Velocity Rate of token circulation calculated as transaction volume divided by circulating supply. Indicates economic activity and utility.

Performance Indicator 5: Burn Rate Sustainability Ratio of daily token burning to daily issuance, indicating progress toward deflationary transition. Currently showing 35% burn rate relative to issuance.

Performance Indicator 6: L1 Economic Viability Economic sustainability metrics for L1 blockchains including fee coverage, validator participation, and operational costs.

5.3 Stability Metrics

Performance Indicator 7: Staking Ratio Stability Variance in staking participation over time, indicating system stability. Low variance suggests robust equilibrium.

Performance Indicator 8: Fee Market Efficiency Responsiveness of fee market to congestion changes, measured by correlation between utilization and fee levels.

Performance Indicator 9: APR Consistency Stability of staking returns over time, indicating predictable reward mechanisms. Important for long-term participant planning.

5.4 Growth Metrics

Performance Indicator 10: L1 Adoption Rate Rate of new L1 blockchain creation and modernization to ACP-77 standards. Indicates ecosystem growth and technical advancement.

Performance Indicator 11: Network Utilization Growth Trend in network utilization over time, indicating adoption and scaling effectiveness.

Performance Indicator 12: Validator Economics Profitability metrics for validators including operational costs, reward rates, and delegation income.

6. Insights into the Avalanche Economy

6.1 Security

The regulatory subsystem (validators and delegators) is subsidized by network inflation and incentivized for good behavior through reward mechanisms. This creates a wealth-gaining economic force for valid transactions and wealth-reducing force proportional to faults, aligning incentives with network health.

Due to the entanglement of stakeholder behaviors, the regulatory subsystem should be managed as a “policy space” with higher-level parameters affecting the subsystem collectively. This approach enables more efficient modeling and control of network security dynamics.

6.2 Sustainability

The governing mechanisms have several control levers including parameter changes, upgrade implementations, and economic policy adjustments. Clear visibility into how governance choices impact the network is critical, especially given the cascading effects across subsystems.

Monitoring network parameters through specific KPIs and health metrics enables successful long-term steering. A computational model representing all subsystems and their relationships assists decision-makers in running experiments and scenario analyses.

6.3 Value Creation

The L1 ecosystem serves as a proxy for value creation in the platform through the continuous fee mechanism. The system’s connection to real-world value flows through L1 utility and adoption, creating intrinsic value that cascades into the network’s economic health.

The financial isolation of L1 activity from the Primary Network, combined with the economic alignment through fees, creates strong incentive alignment while maintaining security separation.

6.4 Stability

Economic stability requires navigation and control through policies that address both internal dynamics and external forces. The system’s power over L1 economics and governance periodicity provides key levers for systemic control.

Treasury management should incorporate buffer mechanisms to absorb volatility, particularly during early network phases. The buffer size should adapt based on network maturity and observed volatility patterns.

7. Conclusion

The Avalanche economic network represents a sophisticated control system where careful mechanism design achieves multiple objectives simultaneously. The differential specification provides the mathematical foundation necessary for understanding these complex dynamics and enables scientific approach to network governance and optimization.

The control-theoretic framework establishes rigorous foundations for analyzing system stability, controllability, and robustness. This approach enables evidence-based governance decisions and provides tools for maintaining economic health as the network evolves.

The journey from theoretical foundations through systems engineering to this differential specification provides a complete toolkit for understanding and governing complex blockchain economic systems in the Web3 era.

References

[1] Ogata, K. (2010). Modern Control Engineering. Prentice Hall.

[2] Khalil, H. K. (2002). Nonlinear Systems. Prentice Hall.

[3] Avalanche Community Proposals. ACP-103: Dynamic Fees. https://github.com/avalanche-foundation/ACPs

[4] Chen, C. T. (1999). Linear System Theory and Design. Oxford University Press.

[5] Narendra, K. S., & Annaswamy, A. M. (2012). Stable Adaptive Systems. Dover Publications.

[6] Zhou, K., & Doyle, J. C. (1998). Essentials of Robust Control. Prentice Hall.

[7] Astrom, K. J., & Murray, R. M. (2021). Feedback Systems: An Introduction for Scientists and Engineers. Princeton University Press.

[8] Sontag, E. D. (2013). Mathematical Control Theory: Deterministic Finite Dimensional Systems. Springer.

[9] Lewis, F. L., Vrabie, D., & Syrmos, V. L. (2012). Optimal Control. John Wiley & Sons.

[10] Dullerud, G. E., & Paganini, F. (2013). A Course in Robust Control Theory. Springer.

[11] Tsitsiklis, J. N., & Bertsekas, D. P. (1997). Introduction to Linear Optimization. Athena Scientific.

[12] Boyd, S., & Vandenberghe, L. (2004). Convex Optimization. Cambridge University Press.

[13] Bemporad, A., & Morari, M. (1999). Control of systems integrating logic, dynamics, and constraints. Automatica, 35(3), 407-427.

[14] Antsaklis, P. J., & Michel, A. N. (2006). Linear Systems. Birkhäuser.

[15] Kailath, T. (1980). Linear Systems. Prentice Hall.